The motivation of this article is to capture select examples of the Australia-Japan innovation activity across diverse stakeholders and to draw attention towards keeping a closer eye on Australia’s innovation ecosystem where many opportunities exist and cut across business, technical and financial collaboration with startups, universities etc.

Japan is an advanced nation that has historically enjoyed the reputation of being a tech front-runner. It has contributed many innovative companies to the world. This has been largely driven by the commitment to quality and a strong work ethic that propelled Japan to economic success in the post-world war II era. Japan went on to become the 2nd largest economy in the world after the United States. This was followed by the ‘lost decade’ when Japan’s economic bubble burst. Since then Japanese companies have been constantly redefining themselves in an ever-evolving world.

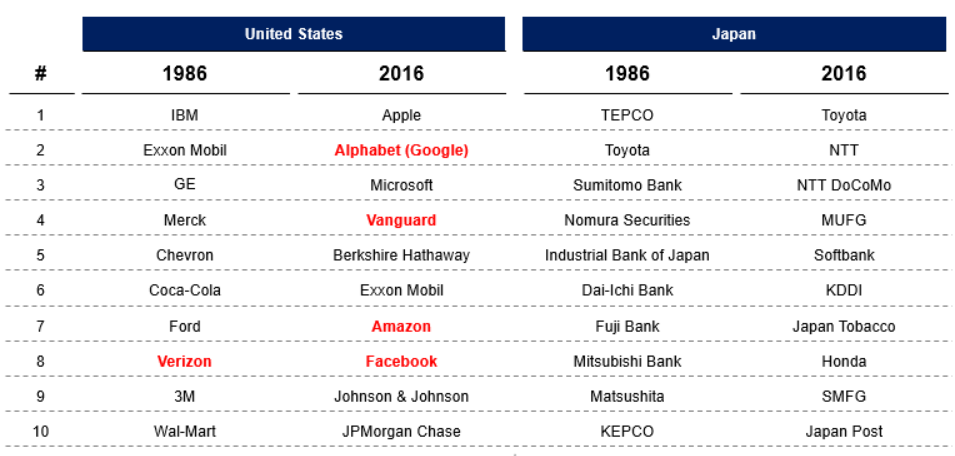

At the same time, if we zoom out to the global stage across the past few decades – where the world was becoming smaller, closer and more global with every passing year, new companies (“startups”) were grabbing the limelight and opening their wings. These companies include the likes of Apple, Google, Amazon etc. which don’t require any introduction. Taking a closer look at the top 10 rankings by largest market capitalization between Japan and USA[1], one would immediately spot that some of the “new” companies that can be seen as torch-bearers of innovation actually became bigger than the conventionally large players such as auto manufacturers, financial institutions etc.

Table 1: Top 10 rankings of the largest market cap companies in 1986 & 2016

(*Companies in red font are 30 years old or less)

The above table reaffirms a very clear message about the importance of innovation. Most corporations are built around a unique set of products or services. That’s why at a certain point, they reach a point of saturation, where their product line has been upgraded/extended to the maximum. The profit margins stop growing so dynamically. When they reach that moment (or are about to), they need to innovate to keep growing[2]. Harvard Business Review reports that since 2000, 52% of enterprises in the Fortune 500 “have either gone bankrupt, been acquired, or ceased to exist” due to digital transformation[3].

In order to innovate, from a Corporate lens, the innovation can be simplistically be classified into two types:

(1) Closed – E.g. Internal R&D, In-house innovation labs, Internal accelerators etc.

(2) Open – E.g. Corporate VCs (CVCs), External accelerators, Innovation teams etc.

In recent years, more and more Japanese companies have been actively promoting the idea of open innovation. With many Japanese companies operating beyond borders in search of new solutions, there are increasing opportunities for overseas companies as well[4]. The typical destinations for open innovation outside of Japan have been the USA, Europe, Israel, Singapore etc. This can be corroborated by a quick search of the destinations where Japanese CVCs mostly set their mandates. For e.g. Sony Innovation fund which has US$250m AUM has offices in US, EU, Israel, Japan and India[5].

With this backdrop, the focus of this article is to draw attention to Australia’s startup ecosystem which sometimes gets overshadowed or under-appreciated amidst the global innovation ecosystems that many Japanese corporations turn towards for their open innovation initiatives.

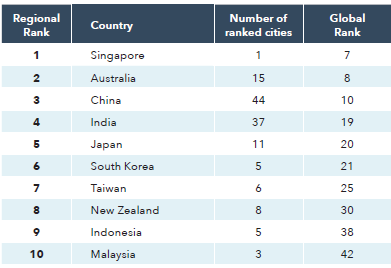

While to some, Australia is more popularly known for sandy beaches and ocean views, Australia’s startup ecosystem (with ~6,500 startups[6]) is promising with innovation across various sectors that is rapidly growing. A study by Startup Blink ranks Australia at 8th place globally and 2nd place within the APAC region for its startup ecosystem[7].

Table 2: Startup Blink Global Ranking Index 2022 – Asia Pacific

The above holistic scorings are based on the sub-scores measuring quantity score (including the number of startups, co-working spaces, accelerators, startup-related meetups, etc.), quality score (including traction of entities in all ecosystems, presence of strategic branches and R&D centers, presence of unicorns, exits, and pantheon companies, global startup events, number of startups backed by accelerators, etc.) and business environment score (including diversity index, internet freedom, R&D investment, number of patents per capita, top universities per location, etc.). Such rankings can help provide a good flavor of the relative prominence of Australia’s startup ecosystem in the region.

When it comes to the sheer scale of startups, Australia has been performing well for its population size with 21 unicorns as of Oct’22 – many of which have been opening their wings on the global stage –

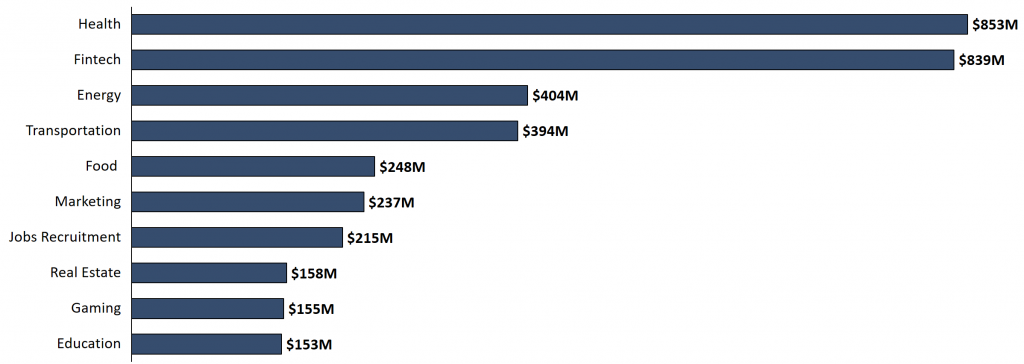

In terms of sector attractiveness from an investor’s perspective, Health, Fintech, and Energy are the top 3 industries that received funding in Australia in 2022. Health startups raised the most money in 2022 ($853 million), followed by Fintech ($839 million), and Energy ($404 million), according to Dealsroom.co. (see Figure 1)

Figure 1: Australian startups’ fund raised by sector in 2022[8]

The Australian innovation startup ecosystem has been growing and is further catalyzing. Australia venture capital Airtree, Blackbird and Square Peg raised a staggering amount of ~$2.5 billion in new funds in 2022 showing confidence to grow the Australian startup ecosystem further.

Japanese companies have been expanding overseas for decades – including Australia. Therefore, Australia is not ‘new’ for Japan but historically it is also true that Australia was largely being seen through the lens of conventional businesses (e.g. “digging the earth” etc.). This was in stark contrast to countries such as the USA that built a strong reputation for technology (e.g. Silicon Valley) during the same period and attracted Japanese corporates to explore innovation opportunities too. For example, many leading Japanese CVCs have strong activities in the USA while in an Australian context, the examples are far and few. This is because, for many Japanese corporations, Australia’s name and perception of innovation don’t come in the same breath as Silicon Valley, Singapore, Israel, etc.

Unfortunately, these perceptions can’t evolve overnight but there are reasons why Japan should look more closely at Australia with a dual objective – (i) Scouting innovation to solve Japan’s challenges and (ii) New business creation opportunities for Japanese Corporates in Japan and beyond.

Some of the various sectors in Australia that can be considered and are not limited to

From a Japanese lens, apart from the facts stated above, some of the reasons why Japan should consider Australia more closely are:

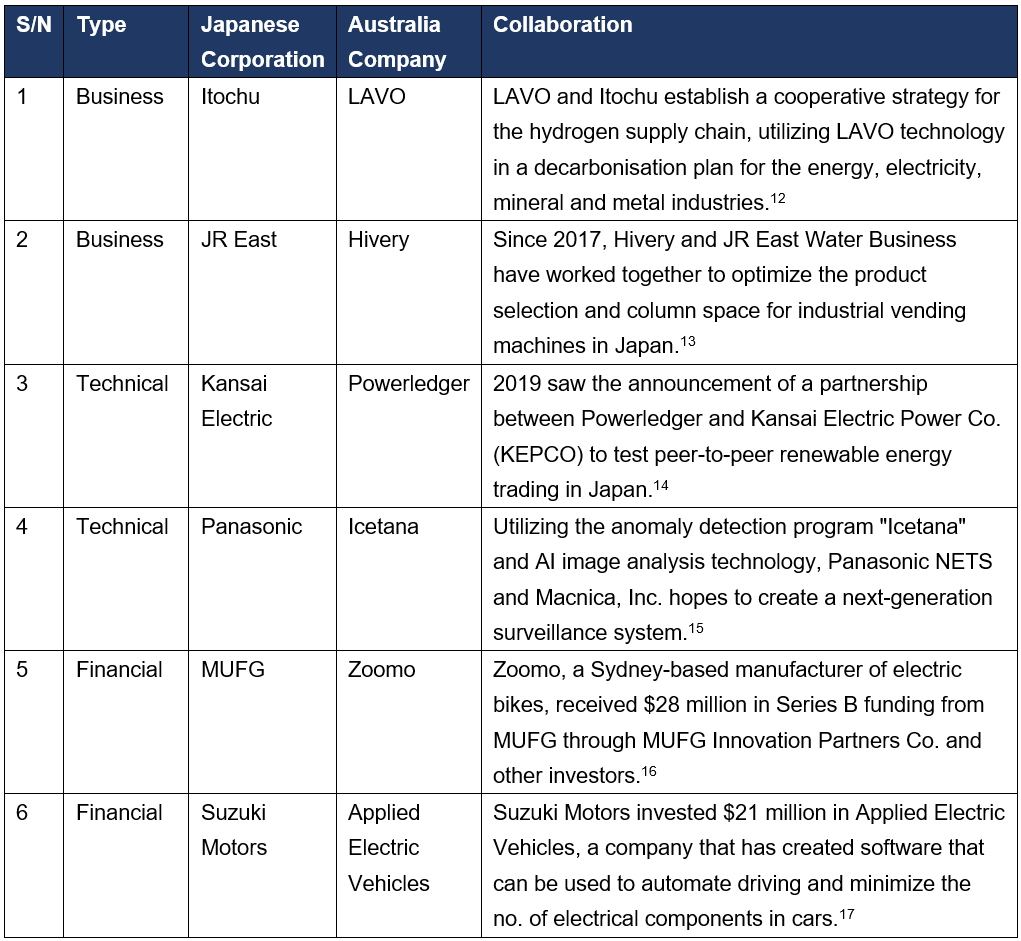

The good news is that in recent years, Japanese Corporates have been getting relatively more active in the Australia-Japan innovation corridors. But don’t take our word for it – let us look at some examples that encompass a variety of ecosystem players, including startups, universities, and financial institutions / venture funds. These various collaborations can be in the form of business, technical or financial collaboration.

Collaborations between Japanese enterprises and Australian startups are growing as Japanese organizations are becoming more receptive to “open innovation” with Australian companies. The spectrum of partnerships in these sectors includes energy, smart cities, mobility, etc. and examples include:

Table 3: Examples of collaborations between Japanese corporation and Australia startups

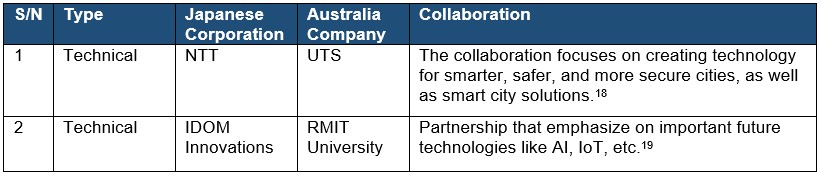

Japan has a great appreciation for the educational and scientific institutes of Australia and new relationships are increasingly being established between Australian universities and Japanese companies. Some examples of collaborations include:

Table 4: Examples of collaboration between Japanese corporation and Australia Universities

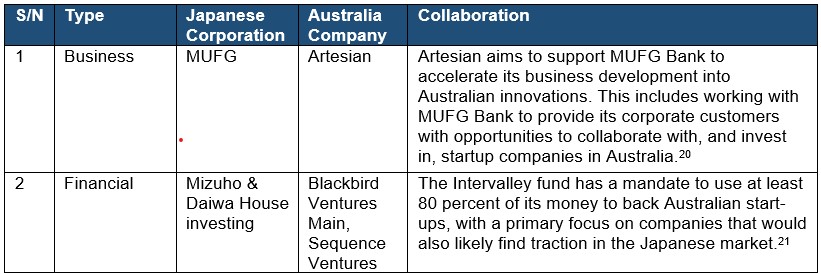

Japanese investors, both new and established, are increasingly trying to focus on the innovation prowess of Australia. Some examples include:

Table 5: Examples of collaborations between Japanese and Australia Financial Institutions / VCs

Collaboration between Australia and Japan can be seen in many different angles and different stakeholders are playing their part to increase awareness and provide support to foster cross-border innovation between both countries. For example, JETRO launched J-Bridge (Australia) in 2021, a platform for exploring various prospective partnerships between Japanese corporations and Australian startups that strives to create a bridge of innovation between the countries.

To conclude, Australia is an exciting region to consider and has been overshadowed by other prominent startup ecosystems in the US and Europe, etc. However, the growing number of collaboration examples in Australia-Japan’s innovation corridors can potentially turn more Japanese Corporates’ attention to this innovation hub down under too – and if you have preconceived notions, you may well be in for a (pleasant) surprise!

IGPI is well networked with most Japanese mega corporations as well as Australian startups – be it Japan (HQ), ASEAN (RHQ in many cases) and Oceania offices and support them for a number of initiatives. If you are an Australian startup, we can assist you find the right potential partner for your market expansion plans beyond Australia. IGPI provides highly customized APAC business advisory to its diverse range of clients including but not limited to:

[1] S&P Capital IQ, Diamond Company Ranking

[2] Iterators, Corporate Innovation Guide: Problems, Solutions & Real Life Use Cases (2023)

[3] Harvard Business Review, Digital Transformation Is Racing Ahead and No Industry Is Immune (2017)

[4] JETRO, The current situation of open innovation in Japan: The points that overseas companies should bear in mind (2021)

[5] Sony Innovation Fund, About Sony Innovation Fund (n.d.)

[6] TechCouncil of Australia, Turning Australia into a regional tech hub, https://techcouncil.com.au/newsroom/turning-australia-into-a-regional-tech-hub/

[7] StartupBlink – Global Startup Ecosystem Index 2022 (2022)

[8] Dealroom.co, Update on Australia’s startup ecosystem in 2022 (2022)

[9] Innovation Intelligence – The future of Australia’s smart cities (2022)

[10] All Things Distributed, Is Australia the new epicenter for healthtech startups? (2023)

[11] AgFunder News, Innovation hub AgriFutures growAG. plans to make Australia the agtech capital of the Southern Hemisphere (2022)

[12] FuelCellWorks, LAVO and ITOCHU Corporation Collaboration to help industries achieve SDG (2022)

[13] Hivery, Australian AI startup, HIVERY, partners with JR East Water Business to optimize vending machines in Japan (2020)

[14] Powerledger, P2P renewable energy trading in Japan (2018)

[15] Icetena, Construction of next gen surveillance system (2021)

[16] Business News Australia, E-bike innovator Zoomo goes full throttle with extra $28m in Series B (2022)

[17] Startupdaily, Suzuki drives $21 million raise for electric vehicle software startup Applied EV (2022)

[18] NTT, University of Technology Sydney and NTT Group partner to promote smarter, safer and more secure cities (2021)

[19] Herbert Smith Freehills, Japan-Australia Investment Report 2022: Decarbonisation (2022)

[20] Ashurt, Landmark business alliance formed between Artesian and MUFG Bank (2023)

[21] AFR, Japanese institutions turn their eyes towards Aussie tech start-ups (2021)

Mr. Rachit Khosla is the Country Manager of IGPI Australia. Rachit is a seasoned strategy consulting professional with over 14 years’ experience of leading and executing market entry and growth strategy (both organic and inorganic) and open innovation engagements for Fortune 500 businesses and large MNCs across Asia Pacific. He has advised clients in a diverse range of industries including automotive, fin-tech, industrial and manufacturing, med-tech & healthcare, smart cities, construction materials, travel, IT & telecommunications to name a few. Rachit was the former Country Manager and Director for YCP Solidiance (Japanese owned) and Founder and CEO of an online B2B marketplace startup for professional advisory services focused on Emerging Markets.

Mr. Nicholas Quek is an Analyst in IGPI Singapore. Nicholas graduated from Singapore Management University with a Bachelor of Business Management, majoring in Finance. During his time in university, he gained internship experience at OCBC bank where he took on a compliance role responsible for AML. He was also a Teaching Assistant for Financial Markets and Investments, and a Research Assistant for Real Estate Investment Trusts (REITs). In his final year, Nicholas embarked on an experiential learning course where he formulated strategies to increase e-commerce sales for an MNC. He also analyzes and identifies innovative Australian companies in the space of carbon neutral, smart city (incl. energy SaaS), mobility, etc. to help foster collaboration with Japanese corporations in ecosystem-level engagements.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around fund supported by the Japanese government.

IGPI has vast experience of supporting Fortune 500s, Govt. agencies, universities, SMEs and startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with it making its own venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with Japan Bank of International Cooperation (JBIC) – one of JV’s initiative is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic and Omron.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.