October 2023 findings from Deal Street Asia (DSA) reveal a notable shift in market dynamics, with Southeast Asian (SEA) startups navigating through the lowest quarterly deal volume in nearly three years. The third quarter, spanning July to September, witnessed only 151 deals being closed, representing a significant 27% quarter-on-quarter decline. Yearly, this translates to a substantial 34% year-on-year reduction in total deal volume and a noteworthy 52% year-on-year decrease in total deal value.

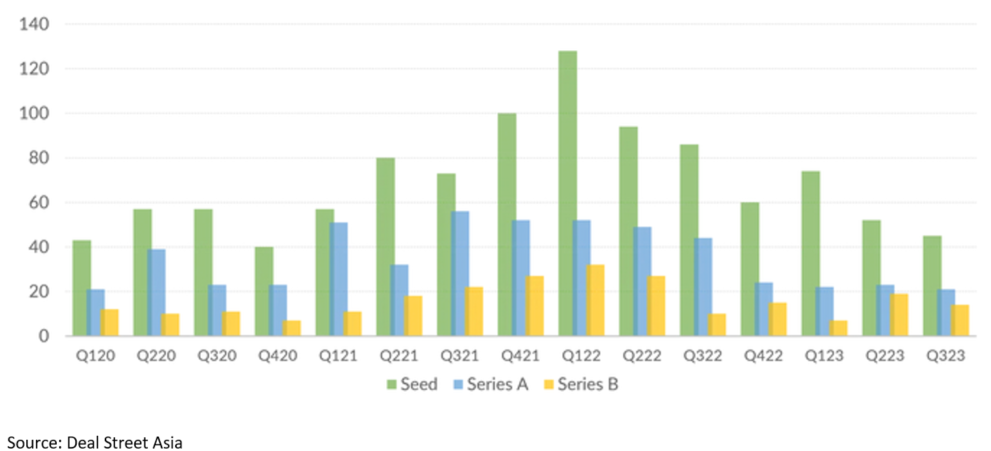

This market shift extends across early-to-later stage funding rounds. Seed-stage deals, in particular, hit a three-year low in Q3 2022, experiencing a volume drop of 44% compared to the same period the previous year. Additionally, the median value of seed rounds softened, falling by 22% over the last nine months. Similarly, Series A to Series D rounds have also encountered significant reductions. Series A deal volume faced a particularly challenging scenario in the initial nine months, while Series C witnessed the deepest correction in median value, plummeting by 59% from the same period the previous year.

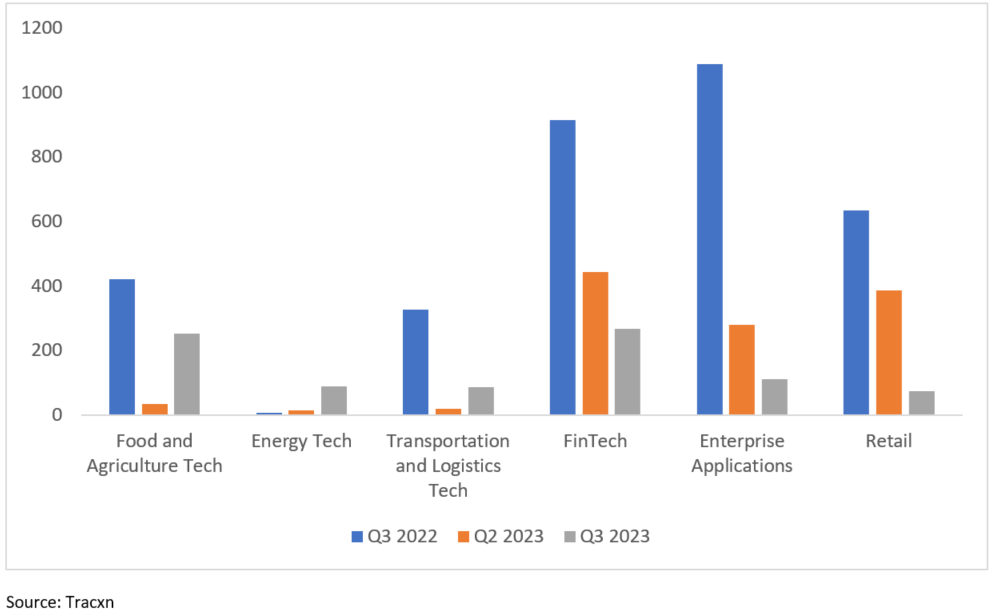

A sector-wise comparison by quarter in Southeast Asia (SEA) reveals the following trends:

In Q3 2023, the Food and Agriculture Tech sector secured funding amounting to $254 million, reflecting a growth of 638% from the $34 million raised in Q2 2023. However, this still represents a drop of 40% compared to Q3 2022. The Energy sector, on the other hand, experienced growth with funding amounting to $89 million in Q3 2023—an increase of 482% and 1014% from Q2 2023 and Q3 2022, respectively.

In 2021, there was a notable surge in startups securing funding at inflated valuations, driven by a pursuit of rapid growth and increased cash burn. However, the trajectory shifted in 2022, signaling a return to normalcy. The market experienced a decline in deal frequency, a moderation in valuations, and a rise in flat and down rounds.

While specific statistics for Southeast Asia (SEA) regarding the proportion of up, flat, and down rounds are unavailable, insights from the U.S. market provide a glimpse into this trend. Carta’s Q3 2023 report revealed that nearly one in five investments in the U.S. was characterized as a down round. The Coller Capital Global Private Equity Barometer for Summer 2023 noted that 59% of Asia-Pacific (APAC) Limited Partners (LPs) anticipate more down rounds in the next 12 months, contrasting with 24% of APAC LPs expecting fewer down rounds.

Highlighting this shift, notable instances of down rounds in SEA in 2023 include Bitkub. As reported by Asia Tech Review, Bitkub, a Thailand-based crypto exchange, attracted a $500 million investment from Siam Commercial Bank (SCB) in 2022 for a 51% stake at a valuation exceeding $1 billion. However, in July 2023, Bitkub agreed to sell a 9.22% share to Asphere for approximately $17 million, valuing the company at $184 million. This case exemplifies the recalibration in valuation dynamics and investor sentiments that have become prevalent in the evolving landscape of startup funding in the region.

Through discussions with investors, industry practitioners, and startup founders, several key reasons have been identified as contributing to the current fundraising downcycle. These include:

– Uncertainty in macro-economic conditions

The recovery in economic performance post-pandemic has been patchy, and geopolitical tensions, such as the Ukrainian-Russian war, the ongoing trade war between the US and China, and the Israel-Gaza War, have brought uncertainty to the overall economy. This has led to supply chain issues that partly contribute to the inflation we see today.

– Higher cost of funds

As a corollary to the prevailing inflation, the US Central Bank, commonly known as “The Fed,” has undertaken a series of 11 interest rate hikes since March 2022. Presently, the Fed Funds rate stands within a range of 5.25-5.5%, while the 10-year Treasury has reached its zenith at above 5%. This upswing in the cost of funds plays a pivotal role in shaping asset allocation strategies.

The escalation in the cost of funds brings forth numerous implications, among others:

The recent lackluster performance of stock markets in October, coupled with the anticipation of prolonged higher interest rates and subdued after-market showings of recent IPOs from the summer, has created a challenging landscape. The potential for significantly reduced valuations is prompting many IPO aspirants to reconsider or delay their market debuts. The continuous rise in the 10-year Treasury yield is especially discouraging for potential deals. Those still contemplating an IPO may face the necessity of accepting substantial reductions in valuation.

– Startup performance not meeting investors’ expectations

Amidst the pandemic, a notable surge in deals at impressive valuations occurred. However, this optimistic trend did not translate universally for startups, as a substantial number faced challenges meeting these elevated expectations. Some even resorted to returning investors’ funds, while others succumbed to bankruptcy and had to implement cost rationalization measures.

One example is Zume, backed by Softbank, which ceased operations in June 2023 after an eight-year run. Initially, the startup embarked on ambitious plans to revolutionize the pizza industry by investing $446 million in equipping delivery trucks with robotic pizza-makers and smart ovens, aiming to freshly cook pizzas en route to customers. However, Zume encountered various technological challenges, including issues with cheese sliding off pizzas. These challenges resulted in increased expenses and faster depletion of funds compared to revenue generation, ultimately leading to the cessation of operations.

Another case is IRL, an event discovery and planning app. Despite raising approximately $200 million across various funding rounds and achieving unicorn status in 2021, the startup faced numerous challenges. A significant expansion in its headcount was followed by a 25% workforce reduction in 2022, indicating deeper underlying issues. The situation worsened when both an SEC probe and an internal investigation revealed that a staggering 95% of the app’s reported 20 million active users were fake accounts. This unsettling truth dealt a fatal blow to the company, resulting in its permanent shutdown. These instances underscore the intricate challenges faced by startups, even amid a backdrop of prolific deal-making during the pandemic.

– Recent IPOs of well-known startups have been disappointing

The recent post-IPOs performance of a handful of startups has been disappointing.

– VC funds have faced difficulties in raising monies, with some having to downsize aspirations

The first quarter of the year has witnessed a notable shift in the venture capital landscape, as reported by Preqin’s latest venture capital report. In a departure from the quarterly average of 460 over the past five years, only 144 venture capital funds successfully closed during this period.

Moreover, the fundraising market is displaying a growing concentration of larger funds. As larger funds have demonstrated an ability to leverage their brand, track record, and scale to secure more capital, especially during turbulent market conditions. Preqin’s findings reveal that a significant half of the capital raised by venture capitalists in the first quarter flowed into the coffers of just five funds. This trend underscores a notable shift in investor confidence and strategy amid a bear market for technology.

It is also reported that funds with a focus on the Asia-Pacific region appear to be in a more favorable position to attract capital compared to their counterparts in North America and Europe. The first quarter saw the closure of the largest fund, Primavera, an Asia-focused venture capital firm renowned for backing industry giants such as Alibaba and Bytedance, which managed to secure a $4 billion commitment, accounting for a noteworthy 15% of the total value of funds closed in the past quarter.

As the venture capital landscape continues to evolve, these trends shed light on the strategies and preferences of both investors and fund managers in navigating the current market conditions.

Given the challenging fundraising environment, it is foreseeable that there will be higher pressure from potential investors pushing for a lower valuation – a “down-round” – whereby the subsequent round of funds raised is valued lower than the preceding round. Such a down-round carries both legal and economic implications.

Often, startup founders may not have a good inventory of terms that they have agreed with in their prior funding rounds; unfortunately, some of these may come to bite them back during difficult times. One of the things that all founders need to pay careful attention to is the anti-dilution provision and specifically how this provision is worded – whether it is full-ratchet or on a narrow/wide-based weighted-average. The full ratchet provision is generally the most onerous one for the founders.

While it is a little too late to modify the provisions of the already agreed anti-dilution terms, knowing, and having a good understanding of these terms will at least let founders plan in terms of potential dilution and how this may impact different stakeholders and guide them in pursuing their future fundraising.

As the old saying goes, “Internally generated cash is always the cheapest source of capital,” so it is very important that founders adopt a “thrifty” attitude. Some of the things that we have come across during such times are for founders to focus on extending the cash runway above all else. To do so, we often see founders re-focusing on their core business. Doing so may necessitate founders closing down pilot/pet projects and non-profitable business segments. An example would be Grab, which has closed its Autoinvest and Earn+ products recently.

At the same time, one tip we have for founders to execute cost restructuring before even considering fundraising. The sooner this is done, the more confident investors are that founders can undertake tough decisions during necessary times. The ability to retain selective key staff and to let go of others is very important in such times. As to profitability, we generally see that many are not yet profitable today, unfortunately. From our feedback and experience dealing with investors and founders of such startups, we strongly advise that founders have a clear idea of how to chart for profitability. Also, some have cut back on spending, and hence growth, just to show profitability. Unfortunately, such a strategy does not work. Clearly, investors, especially VCs, understand that such businesses will not be attractive for funding as well.

We also advise founders to reach out to the investors in their cap table and consider a follow-on/extension round to raise money under the same terms. Investors who have already invested in your company should be rightfully aware and have a better understanding of your company’s situation. Hence, they are in a better position to help during a downturn. Such a round typically allows the business some room for survival to tide through difficult periods.

Besides this, investors may also seek bridge financing from current investors. The key to successfully executing this is to be very clear on the proceeds of this fund and ensure that the amount raised through this extension leads to a meaningful milestone that will allow them to get through this difficult period.

We also advise investors to look for alternative ways to gain funding – one of which has gained popularity these days is to raise debt funding (popularly known as Venture Debt or Private Credit). However, this strategy may work best for startups that have collaterals – such as receivables backed by credible paymasters or have assets that have visible liquidation value – such as land/property.

Many venture debt funders we spoke to have also mentioned that having a good VC name in the cap table and having these VC personnel heavily involved in the startup’s management team, such as being part of the board or having an oversight of the startup’s management, helps in their underwriting. These VC involvements provide some assurance in terms of follow-on funding and governance, respectively.

That said, founders need to be fully aware that the venture debt’s cost of funding today can go as high as 15% in USD term. We also advise that it is important to negotiate credit terms that work best for both parties – not only on the interest rate but also on the repayment schedules. In addition, some venture debts may consider lower interest rates in place of having an option to purchase shares in the startup in the future (Warrants) if they see the startup as promising.

We also see some banks extending a program to financestartups – in Indonesia, for example, recently we saw Superbank – a digital bank supported by Grab and Singtel secure a partnership with Genesis Venture to provide debt-funding solutions to innovative Indonesian startups. This can also be an alternative source of funding that founders need to look into. Other than this, crowdfunding platforms and government grants (where the startups can have access to such funding lines) may also be useful in this difficult time.

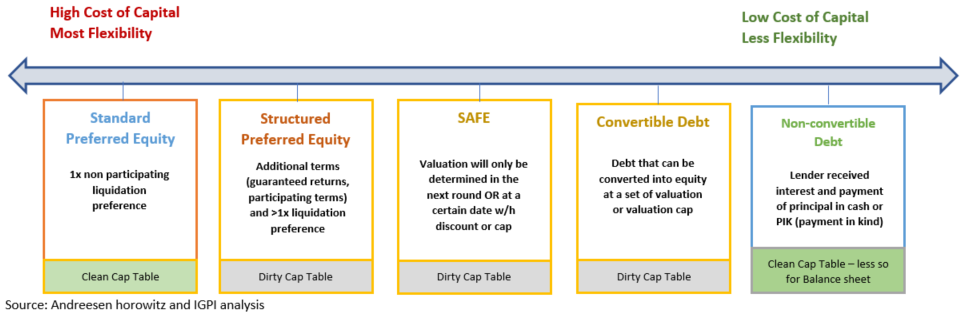

Other than sourcing for alternative sources of funding, startups may take away the conversation on valuation this round by having it structured as convertible debt or SAFE (Simple Agreement for Future Equity). Doing so is essentially kicking valuation further down the road.

Another alternative is to perform a structured preferred equity round – for instance, agreeing on friendlier terms for investors during this funding round like a higher liquidity preference – such as a 1.5-2.0x liquidity preference in combination with participation rights or to sweeten things up, you may also include guaranteed terms. Again, founders need to strike a balance between giving out too much and “dirtying up” the investor terms – which will save them in terms of valuation but will haunt them later if things do not go as planned.

At the end of the day, a down round may not be all too bad. Founders need to realize that it is not the end of the world when such things happen. The key is to understand that there are options to mitigate this and if all goes well, while not perfect, allow founders to keep their startups safe through the funding winter.

IGPI Singapore has worked and collaborated with players in the startup ecosystem, including the founders of startups from various stages and sectors, VCs/ PEs, fellow advisors, and strategic regional and global investors as both strategic and M&A advisors. Through our vast experience in negotiating and dealing with both up and down cycles, we offer tailored, suitable advisory solutions in different funding environments. We understand the difficulty of today’s fundraising environment and provide our independent, professional solutions suited to your startup’s funding needs.

IGPI Singapore can support your company in its business development and maximize its chances of success – Get in touch with us here!

Mr. Erwin Thio is the Senior Manager of IGPI Singapore. His areas of expertise are in M&A deal management (both buy-side and sell-side), deal structuring, valuation and commercial due diligence, market analysis, and project management. He has also spent several years working within the investment and fund management (particularly for Real Estate Private Equity Funds) division of major developers such as Mapletree, Lendlease, Savills IM, and CFLD, where he helped with deal execution and origination, capital raising, fund creation/ development, and management.

Mr. Marcus Tan is an Associate of IGPI Singapore. He has started his career with IGPI. He graduated from Singapore Management University with a Bachelor of Business Management, majoring in Finance. During his time in university, he has gained overseas internship experiences in the chartering and offshore industry.

Industrial Growth Platform Inc. (IGPI) is a premium Japanese management consulting and M&A advisory firm headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai, and Melbourne. IGPI has 14 institutional investors, including prominent Japanese mega-corporations such as Nomura Holdings, SMBC, KDDI, Recruit, and Sumitomo Corporation to name a few.

IGPI has vast experience in supporting Fortune 500s, Govt. agencies, universities, SMEs, and startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation, etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with its making its venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with the Japan Bank of International Cooperation (JBIC) – one of JV’s initiatives is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic, and Omron.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.