The rapidly growing trend of decarbonization poses a serious challenge to ASEAN countries experiencing rapid economic growth. To tackle these challenges, ASEAN countries are looking for partners outside the region. This article describes the recent decarbonization movement in ASEAN, how Japan is supporting it, and how IGPI’s business consulting services can help clients in Singapore and beyond.

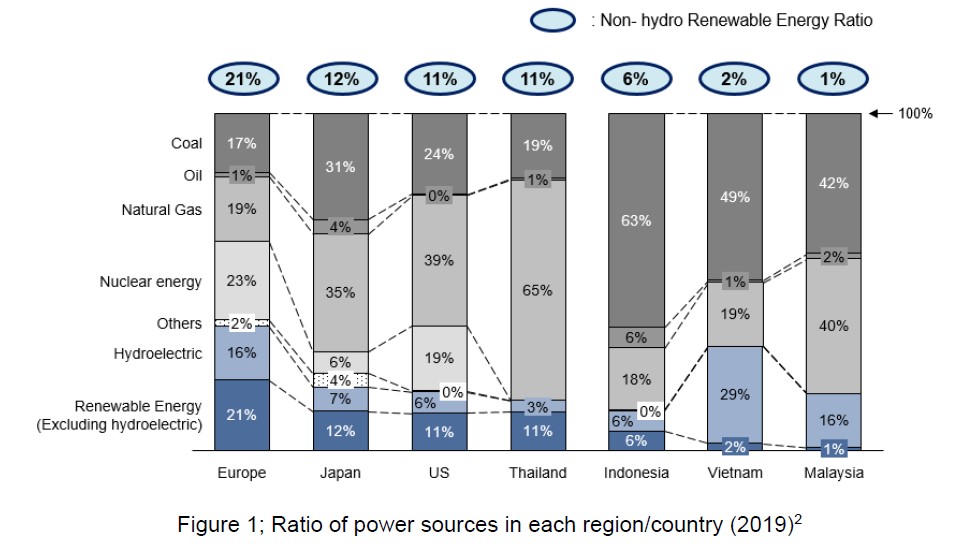

A notable feature of the 2015 Paris Agreement is that it covers all major carbon emitters, including developing countries. This differs from the previous Kyoto Protocol which obligated only some developed countries to reduce their emissions. While the Paris Agreement is a breakthrough in terms of ensuring fairness, we need to keep in mind that the situation in many ASEAN countries is different from that of developed countries that are leading in decarbonization. One major challenge is the problem of dependence on fossil fuels in the region, which hinders ASEAN countries from decarbonizing. ASEAN countries are experiencing rapid growth in demand for electricity as a result of ongoing economic growth. To meet this demand, they have built more thermal power plants using fossil fuels, mainly coal, which is cheap and abundant in reserves. In contrast to Europe, one of the first regions to launch a decarbonization strategy, and where renewable energies (excluding hydropower) account for 21% of power generation, the share of renewable energies in ASEAN countries is lower (11% in Thailand, which has the highest figure among countries in the region—in other nations, renewable energies only make up less than 10%1). It is also worth noting that the percentage of coal-fired power generation, which has a particularly significant environmental impact, is relatively high in the region. For example, in Indonesia, coal accounts for generating than 60% of the total power consumed (Figure 1). As a result, greenhouse gas (GHG) emissions in the region have significantly increased due to the heightened consumption of fossil fuels.

In the light of the above, ASEAN is in a difficult situation due to the global trend towards decarbonization. However, there are also positive factors.

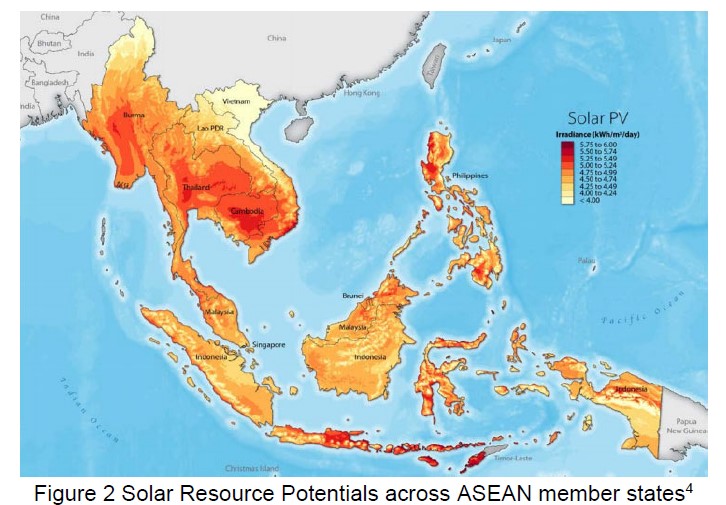

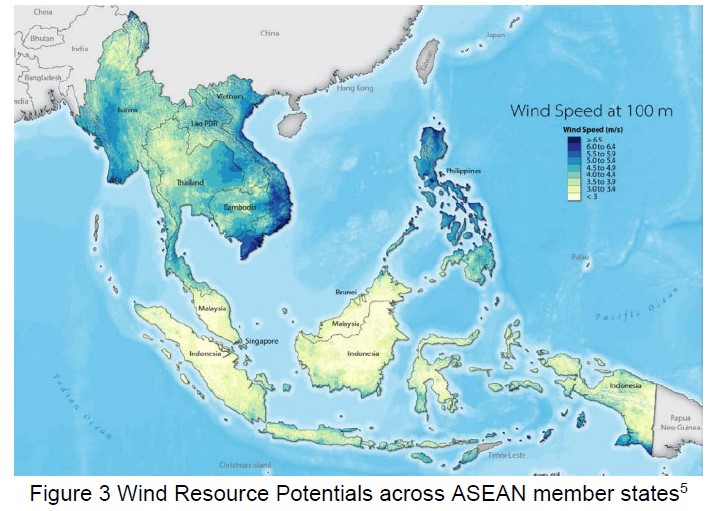

For example, the potential for renewable energy is huge in the region thanks to the abundance of resources. As for solar power resources (as seen in Figure 2) ASEAN countries are generally blessed with abundant solar radiation and high utilization rates are expected. Wind power generation (as seen in Figure 3) is also expected to have a high utilization rate in countries such as Myanmar, the Philippines, Thailand, and Vietnam, where the average wind speed is high in coastal and inland areas. In order to take advantage of these strengths, the governments of ASEAN countries are implementing policy measures to encourage the introduction of renewable energy. For example, Vietnam, which has had to cope with high electricity demands due to delays in the expansion of coal-fired power generation facilities, introduced a FIT system under which the Vietnam Electricity (EVN) buys electricity generated from solar power at a high price. As a result, the country’s power generation capacity grew from just 105 MW in 2018 to over 16 GW in 2020. Vietnam is now the number one solar power producer in Southeast Asia. Currently, the country has preparations underway for the release of the Power Development Plan VIII (PDP8). The third draft of PDP8 strengthens the policy of renewable energy expansion by stating that the share of renewable energy shall increase to nearly 30% by 2030. This will be achieved by scaling up wind and biomass power generation3.

Another decarbonization movement in the region is the promotion of shifting to Electric Vehicles (EVs) in the field of transportation. Traffic congestion a serious problem in many major cities in ASEAN, and the resulting air pollution caused by gas emissions is a critical issue in the region. The Thai government was one of the first to launch an investment incentive program for EVs and battery production in 2017 and has set a goal of having 30% of vehicles produced in the country be EVs by 20306. In Vietnam, VinFast, a subsidiary of one of the country’s conglomerates Vin Group, has proposed the Vietnamese government to exempt EVs from special consumption tax and vehicle registration fees for five years to incentivize the use of EVs. Vietnam’s Ministry of Industry and Trade and the Ministry of Transport are positively considering the idea7.

As shown by the above initiatives, ASEAN countries are gradually following close upon Europe and other developed nations in their efforts to achieve decarbonization.

For ASEAN countries to achieve decarbonization, it is important for the region to collaborate with other countries to incorporate technology and joint development. Japan and ASEAN countries have been trading various products for decades. In the field of electric power, Japan has been exporting power generation technology—mainly gas-fired and coal-fired power generation. They have also developed local Japanese power plants. Due to the current trend of decarbonization, business tractions between both parties are bound to change. However, it is expected that Japan can become a strong ally to ASEAN given the bilateral relationship with the region built over past decades.

As a matter of fact, at the Special Meeting in June 2021, Japan agreed to support the gradual reduction of greenhouse gases in ASEAN countries. Japan announced 1 trillion yen of investment and/or credit line to be implemented by its public and private sectors for the purpose of introducing renewable energy and strengthening energy conservation projects for countries in ASEAN. During this meeting, Japan and Southeast Asian countries also agreed to establish a cooperative framework for the dissemination of CCUS technology (technology for capturing, storing, and reusing carbon dioxide emissions), to involve more than 100 private companies and/or research institutes in sharing Japan’s technologies and knowledge, and to conduct joint research8.

With the strong ties between Japan and Southeast Asia, examples of joint development in decarbonization have already been identified. A few examples are as follows:

IHI is developing a new CO2 recycling technology in collaboration with the Singapore Institute of Chemical and Engineering Sciences (ICES). The company has been conducting joint research and development in the fields of environment and energy since 2011. In 2019, IHI developed a device for methanation. This device produces methane from CO2 using a methanation catalyst9.

MTI is a joint research partner participating in a study on renewable tidal energy with MAKO Energy Pte. Ltd., a subsidiary of Australian tidal turbine manufacturer Elemental Energy Technologies Ltd., and Sentosa Development Corporation which develops Sentosa Island under the Ministry of Trade and Industry. The project aims for the first commercialization of marine renewable energy in the country10.

It is expected that the number of cases of collaboration at both the public and private levels of Japan and ASEAN as mentioned above will continue to increase. There are many business opportunities for private companies, so it is important to seize the appropriate opportunities and take an appropriate approach. IGPI’s Japanese consulting services can help identify such opportunities in Singapore. Decarbonization is an urgent issue that the entire world will tackle, and player landscape, related regulations, required technologies, etc. will change day by day. In such an environment, it is important to:

IGPI’s Singapore office was established in 2013. Since then, we have supported many Japanese companies in their activities in ASEAN. To deal with the above issues, IGPI can provide a variety of business consulting services. Some of our consulting solutions include, but are not limited to:

To find out more about how IGPI can provide Japanese consulting support for business in Singapore and the region, browse through our insight articles or get in contact with us.

About the author

Mr. Tatsushi Sasakura is an Associate Manager of IGPI Singapore. Tatsushi has worked in Mizuho Bank and Deloitte Tohmatsu Financial Advisory (DTFA) in Japan. At DTFA, he belonged to the Corporate Strategy team specializing in business strategy planning, M&A advisory, and business due diligence. He was also engaged in crisis management, supporting clients to tackle emergencies. He has profound experience in the energy, consumer, and financial industries. He covered a wide range of clients including Private Equity Funds and large-sized companies. Tatsushi graduated from Waseda University with a B.A. in International Political Science and Economy.

About IGPI

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around fund supported by the Japanese government.

In 2017, IGPI collaborated with Japan Bank for International Cooperation (JBIC) to form JBIC IG, providing investment advisory services and supporting overseas investment. In 2019, JBIC along with BaltCap has jointly established Nordic Ninja, a €100 million venture capital fund to focus on deep tech sectors such as autonomous mobility, digital health, AR/VR/MR, artificial intelligence, robotics and IoT in the Nordic and Baltic region. In 2019, IGPI established IGPI Technology to focus in the area of science and technology. The company invests in technological ventures and provides hands-on management support. The company also provides business development support towards commercialization and monetization of technologies.

Get in touch with us on decarbonization, strategic planning and new business development related topics!

Kohki Sakata

Chief Executive Officer

+65 81682503

k.sakata@igpi.co.jp

Tatsushi Sasakura

Associate Manager

+65 9457 6052

t.sasakura@igpi.co.jp

This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

1 BP (2020)

2 BP (2020)

3 JETRO (2021)

4 USAID-NREL Partnership (2020)

5 USAID-NREL Partnership (2020)

6 The Nation Thailand (2021)

7 NNA Asia (2021)

8 Ministry of Economy, Trade and Industry (2021)

9 Economic Development Board (2021)

10 Monohakobi Technoloy Institute (2018)