In the financial business market of Southeast Asia, B2B financial services integrated with operational DX for SMEs will be the key.

This article delves into the author’s perspective that the frontier of Fintech in the Southeast Asian market is shifting from the B2C domain to the B2B domain based on the latest Fintech trends.

So, what exactly is Fintech? While Fintech can be defined in various ways across different media sources, this article defines it as ‘financial solutions’ that meet at least one of the following two conditions:

1. Using digital technology to provide financial services to a broader user base than previously possible.

2. Using digital technology to increase the value of financial services provided to users.

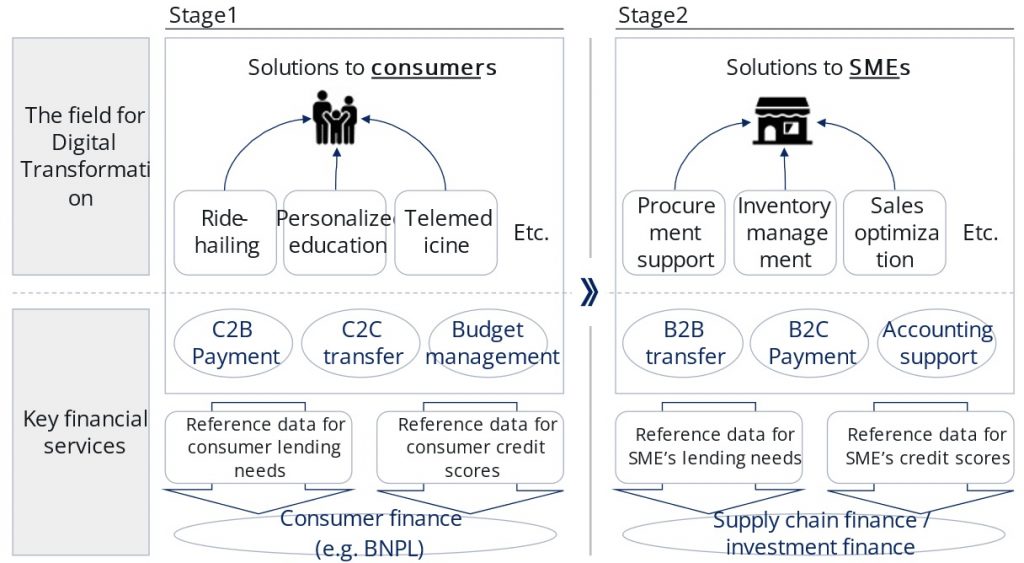

One fundamental aspect to understand is that “financial services rarely stand alone.” This is because financial services typically involve the movement of money, which is accompanied by the movement of related information, such as the product or service being paid for, collateral assets, or credit involved in a loan. Since “money isn’t free,” the evolution of Fintech services is inevitably influenced by the degree of digitization of peripheral services. Thus, it is safe to say that advancements in Southeast Asia FinTech are closely linked to how digital transformation impacts the broader financial ecosystem.

Since the 2010s, the digital transformation in Southeast Asia has rapidly advanced in the B2C domain, reaching levels of convenience that surpass those in some advanced countries like Japan and Europe, particularly in sectors such as mobility, education, and healthcare. Examples of this Southeast Asian Fintech evolution include lifestyle support platforms like Grab (Singapore) and Gojek (Indonesia), which initially began as ride-hailing services. Additionally, personalized online education solutions like Geniebook (Indonesia), and online medical consultation solutions through platforms like Alodokter (Indonesia) highlight the advancements in ASEAN Fintech.

In the ASEAN Fintech landscape, digital services such as C2B/C2C payments and budget management have emerged alongside these innovations. Additionally, the data obtained from these services is used to assess consumer credit scores and lending needs, leading to the provision of consumer finance services like BNPL (Buy Now, Pay Later).

However, consumer financial services, particularly payments and BNPL, often face intense competition, resulting in persistently high customer acquisition costs. For example, Atome, a BNPL service provider based in Singapore, announced in May 2023 that it would cease all operations in Vietnam more than a year after entering the market.

Conversely, the digitization of operations for SMEs, which are the backbone of the Southeast Asian economy, remains sluggish, and productivity continues to be low. For instance, the situation in Thailand, a relatively advanced region in Southeast Asia, is as follows:

Agriculture:

| ✓ | Despite 47% of Thailand’s land and 33% of its labor force being engaged in agriculture, agricultural production accounts for only 8-11% of GDP. | |

| ✓ | 30% of agricultural households carry debt exceeding the average annual agricultural income per capita, with 10% carrying debt three times that amount. | |

| ✓ | Total rice production has decreased from 38 million tons in 2012 to 22 million tons in 2022. | |

| ✓ | Only 23% of farmers use ICT-related tools in their operations. |

Logistics:

| ✓ | B2B deliveries from region to region often use point-to-point routes, resulting in low loading efficiency for LTL (less than truckload) shipments. | |

| ✓ | 46% of annual freight transport involves empty backhauls. | |

| ✓ | In 2020, Thailand’s domestic logistics costs accounted for 14% of GDP, higher than the Asia-Pacific average (12.9%) and many other regions worldwide. |

Given this situation, some financial solution providers focus not solely on financial issues but also on supporting the productivity enhancement of SME operations. They capture financial needs and monetize by providing tailored financial solutions. For example:

| ✓ | CrediBook (Indonesia) assists MSMEs and mom & pop stores with digitizing operations and securing financing by offering a bookkeeping and reporting SaaS tool, which simplifies the process of applying for micro-financing from financial institutions easily. | |

| ✓ | Kilimo Finance (Vietnam) operates through a digital marketplace, allowing Vietnamese farmers to purchase farm inputs (e.g., seeds, crop protection, and equipment) through a wide network of suppliers. It also seeks to connect small and medium-scale agriculture players to commercial banks to enable access to formal credit through its automated credit scoring and loan origination software. |

In the future, Fintech players who contribute to improving SME productivity using digital technology and, through this process, meet customers’ financial needs while leveraging credit score-related data to provide financial solutions will occupy an essential position in the Southeast Asian market.

Considering this Southeast Asian Fintech trend, B2B operation DX technology companies might use the data they acquire to offer additional financial services, either directly through earning interest income or through partnerships with financial institutions. Conversely, existing financial institutions can acquire new customers by partnering with, investing in, or acquiring technology startups that drive digital transformation in adjacent areas of finance in Southeast Asia. They can also improve credit scoring accuracy by utilizing income statement-related information such as sales and balance sheet-related information such as accounts payable obtained through operational support, enabling risk-mitigated financing.

Particularly in emerging markets, SME financing is a significant revenue expansion opportunity for both parties due to its higher risk and higher interest rates.

IGPI offers business model hypothesis construction and verification, partnering support, and M&A support during the execution phase, not only for financial institutions but also for technology companies. If IGPI can be of assistance, please contact us through our website.

Mr. Tadasuke Noguchi is a Manager at IGPI Singapore. Before joining IGPI, Tadasuke worked in an IT company and a think tank in Japan, where he engaged in consulting projects such as new business development in various industries: automotive, logistics, retail, finance, etc. He has experience in hands-on new business development while on loan to Toyota Motor Corporation’s R&D department. In IGPI, He mostly focuses on consulting projects such as market entry/expansion in the ASEAN market, M&A advisory, and the formulation of long-term visions. Tadasuke graduated from the University of Tokyo with a B.A. in Language and Culture and acquired a certification from the Graduate School of Public Policy of The National University of Singapore. He enjoys traveling and has visited around 50 countries.

Industrial Growth Platform Inc. (IGPI) is a Japan-rooted premium management consulting & investment firm headquartered in Tokyo with offices in Osaka, Singapore, Hanoi, Shanghai & Melbourne. IGPI was established in 2007 by former members of Industrial Revitalization Corporation of Japan (IRCJ), a USD 100 billion sovereign wealth fund focusing on turnaround projects in Japan. IGPI has 13 institutional investors, including Nomura Holdings, SMBC, KDDI, Recruit & Sumitomo Corporation, to name a few. IGPI has vast experience supporting Fortune 500s, government. agencies, universities, SMEs, and funded startups across Asia and beyond for their strategic business needs and hands-on support across a wide variety of industries. IGPI group has approximately 7,500 employees on a consolidated basis.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.