Japanese companies, which have swept Southeast Asia in the automobile and energy industries, have not been able to fully take in the growth of the consumer market in Southeast Asia. Although it already has a business base in Southeast Asia, it has not been able to sufficiently create new businesses. This is because in Southeast Asia, where the environment is undergoing rapid transformation, "Exploration" is required more than before, but many Japanese companies are hampered by past successful experiences and lack the organizational capability for exploration. On the other hand, some Japanese companies have been engaged in exploration activities and have achieved certain results.

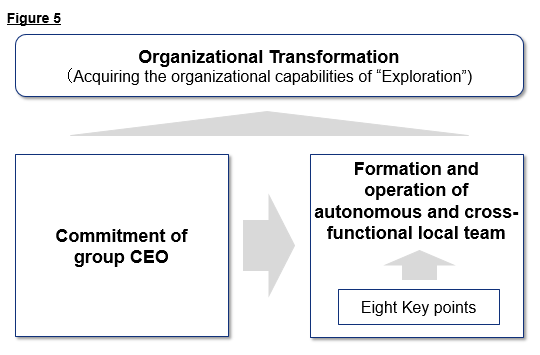

The result of the joint research with JETRO Singapore suggests that for Japanese companies to succeed in creating new businesses and continue to grow in emerging Asian countries, there is an urgent need for organizational transformation for exploration. To achieve the transformation, it is necessary to form and operate a local team that is autonomous and cross-functional and to get sufficient support from the group CEO. There are also eight key factors for the formation and operation of the team.

* This article is based on a research project conducted jointly by Japan External Trade Organization (JETRO) and IGPI Singapore, and it is published with JETRO’s permission. The detailed report is available on JETRO’s website (Only in Japanese).

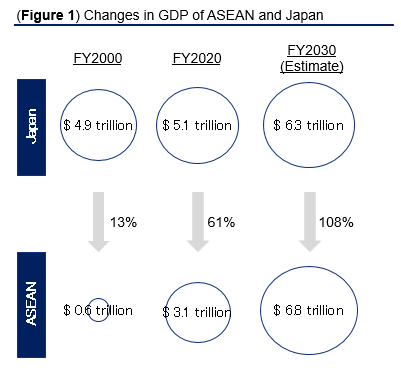

The population of 10 ASEAN countries is about 660 million, making it the third-largest region after China and India. In recent years, GDP has increased rapidly with the rise in per capita income, rising from $ 0.6 trillion in 2000 to only 13% of Japan, to $ 3.1 trillion in 2020, 61% of Japan. It will account for 6.8 trillion yen in 2030, which is expected to exceed Japan’s GDP (see Figure1[1]).

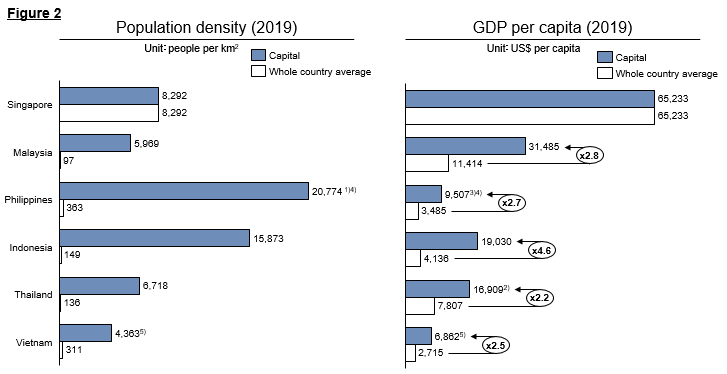

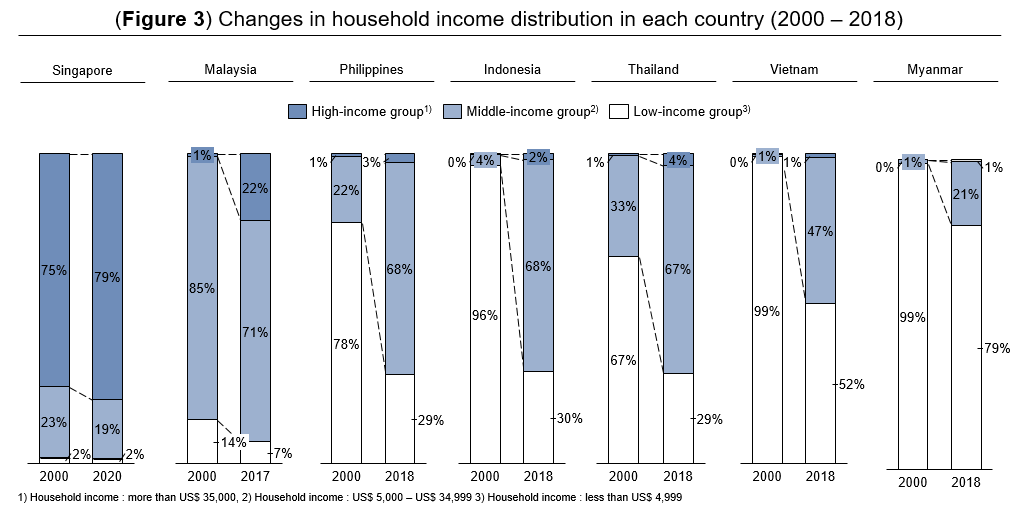

In ASEAN, along with the urbanization, in which more and more people gather in cities, the ratio of the middle class is increasing in many countries, promoting economic development in the area. In many ASEAN countries, the ratio of middle-class or higher households is more than 50% nowadays. It is even expected that not only the middle class but also the wealthy class will increase in the future (see Figure2[2], 3[3]).

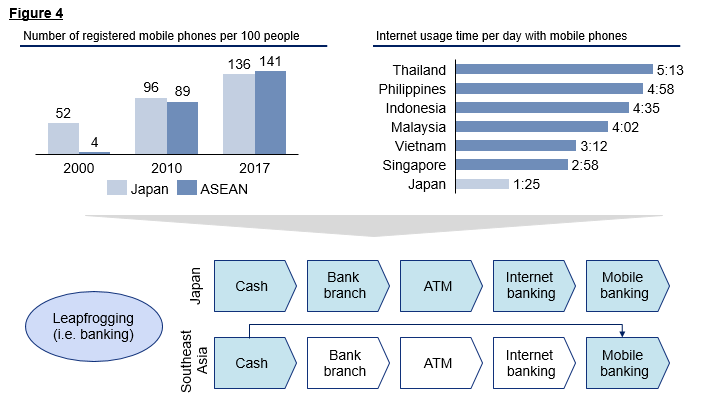

Furthermore, in ASEAN, the penetration rate of smartphones is increasing more rapidly than in developed countries such as Japan, and people in ASEAN use smartphones much more frequently and longer a day compared to people in Japan. As a result, the leapfrogging (accelerating development by skipping inferior, less efficient, more expensive or more polluting technologies and industries, and moving directly to more advanced ones) has also occurred, and the business environment has changed significantly (see Figure 4[4]).

The rapid changes mentioned above have given not only opportunities in the growing market, but also opportunities from the rising demand for solutions to various social issues such as traffic congestion, medical shortages, and lack of service quality. However, amid such rapid changes, the ability related to exploration is required more than before. It mainly consists of the creativity to make a new business concept through careful observation of the site, and the agility to repeat the planning and verification of new business hypotheses at high speed.

In response to these changes, emerging digital and tech companies such as Grab and Go To (Gojek & Tokopedia) are achieving continuous transformation and growth while developing new businesses one after another through quick top-down decision making, etc in Singapore and other countries in Southeast Asia.

Three or forty years ago, when the environmental changes in ASEAN were gradual, Japanese companies were very successful in ASEAN with the strength of operational excellence (organizational capability of “Exploitation” to make better things faster and cheaper) in mainly manufacturing industries such as automobiles.

However, the mindset and customs cultivated by this successful experience, and the various systems that supported this success such as the lifetime employment system have been hampering many large Japanese companies to change. As such, they are having a hard time creating new businesses in the current changing environment in ASEAN.

On the other hand, some Japanese companies have been engaged in exploration activities and have achieved certain results. For example, in an emerging country in Asia, a Japanese company in the medical equipment industry has co-created a service with a startup that provides digital services that are expected to have synergistic effects with its high-quality product, released the service in a short period, and achieved financial performance exceeding the initial plan.

In fact, Japanese companies that have strengths in exploitation activities have the potential to realize further growth in emerging countries in Asia by acquiring organizational capabilities of exploration. Organizational transformation is an urgent issue for many large Japanese companies.

Therefore, IGPI Singapore, in collaboration with JETRO Singapore, conducted interviews with more than 30 Japanese companies that are actively engaged in exploration activities. We have found out there are two main points for Japanese companies to transform and acquire their organizational capabilities of exploration (see Figure 5).

The first is to form and operate an autonomous and cross-functional local team. If the headquarters empower the local team and it can engage in various activities related to creating new business autonomously by itself, the agility of the team will be improved. In addition, by increasing the diversity of the organization (adding members with various backgrounds to the team), it is possible to easily conceptualize business plans from a new perspective, and even if they encounter problems, they will be able to come up with the ideas of solutions from various angles.

The other is for the group CEO to commit to ensure that such a local team is formed and operated properly. Since the nature of exploitation of existing businesses and exploration for new businesses are different, there are often conflicts in terms of resources, etc., and it is often required that the CEO take the initiative in providing support to the local team.

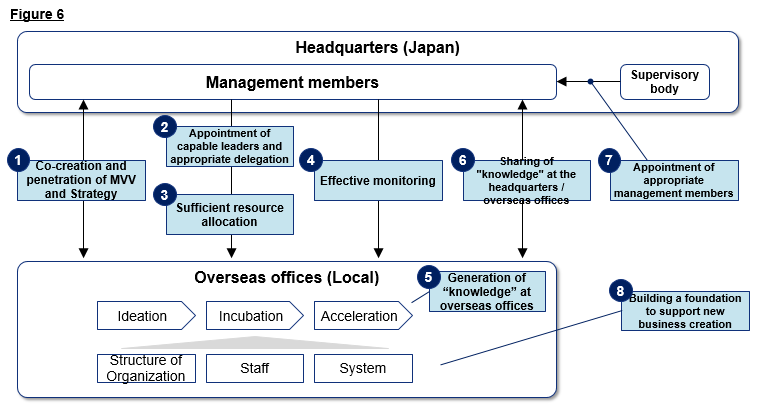

Then, what should be done to realize the formation and operation of an autonomous and cross-functional local team? There are eight key factors (see Figure 6).

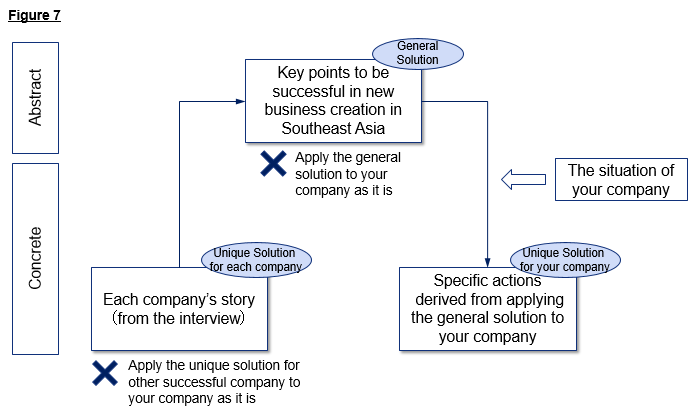

The above eight factors are general solutions that inductively derived success factors and failure factors from the cases of each company interviewed. However, because management is highly individual, it often fails for any company to apply the general solution or the success stories of other companies as they are. The important thing is to identify the essence of the main point as a general solution, interpret it correctly in light of the company’s unique circumstances (including strengths and weaknesses), and apply it (see Figure 7).

Whether for digital or traditional organizations, smart transformation is key to growth. Since its establishment in 2013, IGPI Singapore has been exploring many Japanese companies for market research, strategy planning, execution support including partner search and approach, ideation, and related training for new business creation in Southeast Asia. We have provided various services to support our activities. By providing these services in the form of accompanying, not only the results of exploration activities but also the value of strengthening the organizational capabilities of each company is provided.

————————————————————————————————————————————–

[1] Created by IGPI from IMF, NLI Research Institute

[2] Created by IGPI from Jetro, World Population Review, Demographia, World Meter, CITIE, IMF, C-GIDD etc.

[3] Same as above

[4] Created by IGPI from Ministry of Economy, Trade and Industry

Jongwoo has worked in ABeam Consulting Ltd, where he engaged in various consulting projects including the development of business plans, creating go-to-market strategy, and hands-on support in several B2B industries such as energy, automotive, ve, IT, etc. He not only develops strategy but also supports clients’ execution of the plan, such as searching for strategic alliance partners and approaching them. He started his career as an auditor in KPMG Japan, leading an audit team for foreign investment banks, and also provided regulation-related advisory services to Japanese financial institutions. He has a bachelor’s degree in economics from the University of Tokyo.

Industrial Growth Platform Inc. (IGPI) is a premium Japanese management consulting and M&A advisory firm headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai, and Melbourne. IGPI has 14 institutional investors, including prominent Japanese mega-corporations such as Nomura Holdings, SMBC, KDDI, Recruit, and Sumitomo Corporation to name a few.

IGPI has vast experience in supporting Fortune 500s, Govt. agencies, universities, SMEs, and startups across Asia and beyond for their strategic business needs such as market entry and digital transformation and growth strategies, various aspects of M&A, innovation advisory, new business creation, etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with its making its venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with the Japan Bank of International Cooperation (JBIC) – one of JV’s initiatives is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic, and Omron.

Get in touch with us on internationalization, strategic planning, and fundraising-related topics!

This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness, and accuracy of such information. All rights reserved by IGPI.